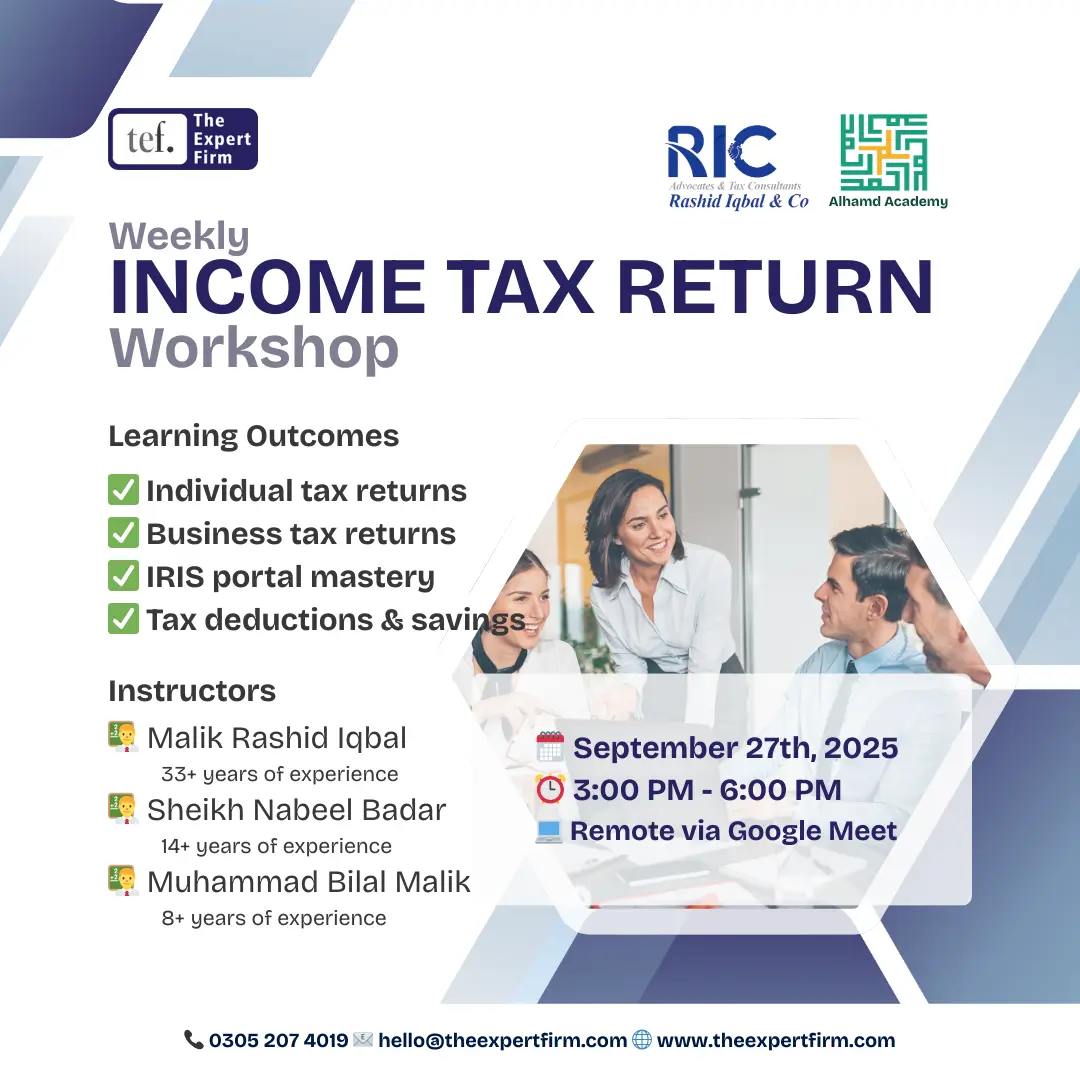

About us

We Are Built for Business – Partner with Experts

At The Expert Firm, we provide reliable tax, accounting, and business advisory services in Pakistan. From FBR registration to company formation, bookkeeping, and wealth management, our solutions are designed to help businesses grow with compliance and confidence.

Whether you are a salaried individual, freelancer, or business owner, our team ensures accurate tax filing, smart financial planning, and professional guidance every step of the way.